how to find the mode of a data set

What is Mode?

Mode is the most frequently occurring value in a dataset. Along with mean and median, mode is a statistical measure of central tendency in a dataset. Unlike the other measures of central tendency that are unique to a particular dataset, there may be several modes in a dataset.

Corporate Finance Institute reviews some of these statistical measures in our Math for Corporate Finance course.

Advantages of Using Mode

In certain cases, mode can be an extremely helpful measure of central tendency. One of its biggest advantages is that it can be applied to any type of data, whereas both the mean and median MEDIAN Function The MEDIAN Function is categorized under Excel Statistical functions. The function will calculate the middle value of a given set of numbers. Median can be defined as the middle number of a group of numbers. That is, half the numbers return values that are greater than the median cannot be calculated for nominal data. It is also not affected by extreme values in datasets with quantitative data Quantitative Analysis Quantitative analysis is the process of collecting and evaluating measurable and verifiable data to understand the behavior and performance of a business. . Thus, it can provide the insights into almost any dataset despite the data distribution.

On the other hand, the statistical measure also comes with its own limitations. For instance, it cannot be further treated mathematically. Therefore, the measure cannot be used for more detailed analysis. In addition, since it is not based on all values in the dataset, it is difficult to draw conclusions regarding the dataset relying on mode only.

For the advantages of other statistical measures and how to calculate and use them, check out CFI's Math for Corporate Finance course!

How to Find the Mode

No calculations are necessary to find the mode. Simply follow the steps below:

- Collect and organize the data from a dataset.

- Determine all the distinct values in a dataset.

- Count the frequency of occurrence for each distinct value.

- The most frequent value(s) is the mode.

In addition, it can be easily found using the distribution graph or histogram Histogram A histogram is used to summarize discrete or continuous data. In other words, a histogram provides a visual interpretation of numerical data by showing the number of data points that fall within a specified range of values (called "bins"). A histogram is similar to a vertical bar graph. However, a histogram, . Graphically, it is represented as the peak point on the distribution graph or the tallest bar on the histogram.

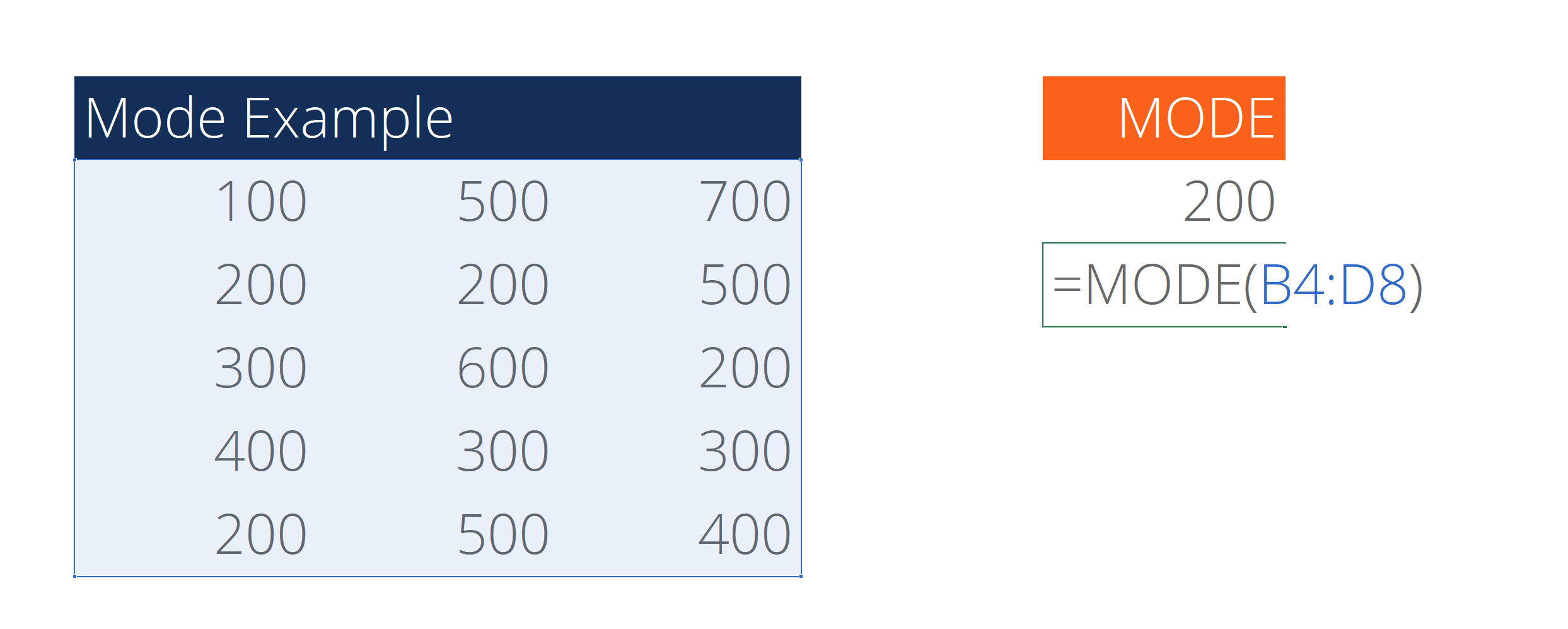

Example of Mode

You are the financial analyst at an e-commerce company Startup Valuation Metrics (for internet companies) Startup Valuation Metrics for internet companies. This guide outlines the 17 most important e-commerce valuation metrics for internet starts to be valued . You've been assigned a task to determine the most frequently purchased category of a product in the last month.

In order to complete the task, you retrieve the data of the purchases for the last month. The data is summarized in the table below:

The task can be completed by determining the mode of the product category in the dataset, which can be found using the steps below:

1. Identify the distinct values in the dataset. We can see that the distinct values of the product categories in the dataset include Apparel, Appliances, Books, and Computer.

2. Calculate the frequency of each distinct value in the dataset.

3. Determine the mode (the most frequent distinct value).

From the table above, we can see that the apparel category is the most frequent in the dataset. In other words, apparel is the mode in the dataset.

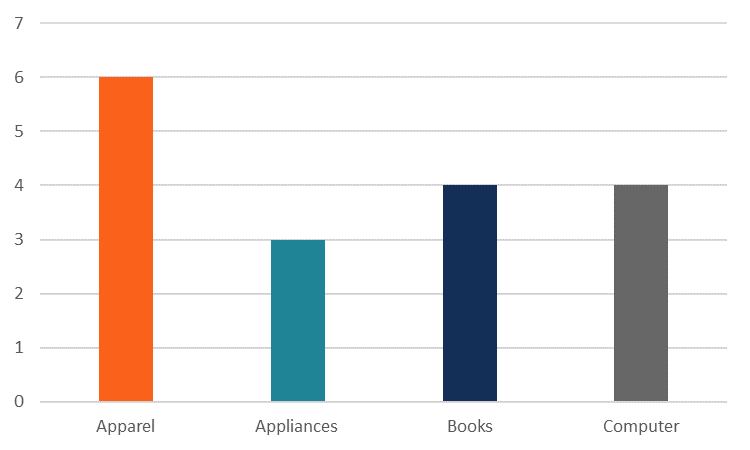

Alternatively, we can find the mode using a histogram (or other frequency distribution chart). Using our original data, we can easily create a histogram in Excel.

From the chart, we can clearly see that the apparel category is the mode in the dataset.

Related Readings

CFI offers the Financial Modeling & Valuation Analyst (FMVA)™ Become a Certified Financial Modeling & Valuation Analyst (FMVA)® CFI's Financial Modeling and Valuation Analyst (FMVA)® certification will help you gain the confidence you need in your finance career. Enroll today! certification program for those looking to take their careers to the next level. To keep learning and advancing your career, the following CFI resources will be helpful:

- Basic Statistics Concepts in Finance Basic Statistics Concepts for Finance A solid understanding of statistics is crucially important in helping us better understand finance. Moreover, statistics concepts can help investors monitor

- Dynamic Dates, Sum, Average and Scenarios Dynamic Dates, Sum, Average and Scenarios Lean how to create dynamic dates, sums, averages, and scenarios in Excel. For financial analysts in investment banking, equity research, FP&A and corporate development, it is advantageous to learn advanced Excel skills because it makes you stand out from your competitors. In this article, we will go through some of the

- Free Excel Crash Course

- Full List of Excel Functions Functions List of the most important Excel functions for financial analysts. This cheat sheet covers 100s of functions that are critical to know as an Excel analyst

how to find the mode of a data set

Source: https://corporatefinanceinstitute.com/resources/knowledge/other/mode/

Posted by: osbornedrel1998.blogspot.com

0 Response to "how to find the mode of a data set"

Post a Comment