How To Get W2 Form From Previous Employer

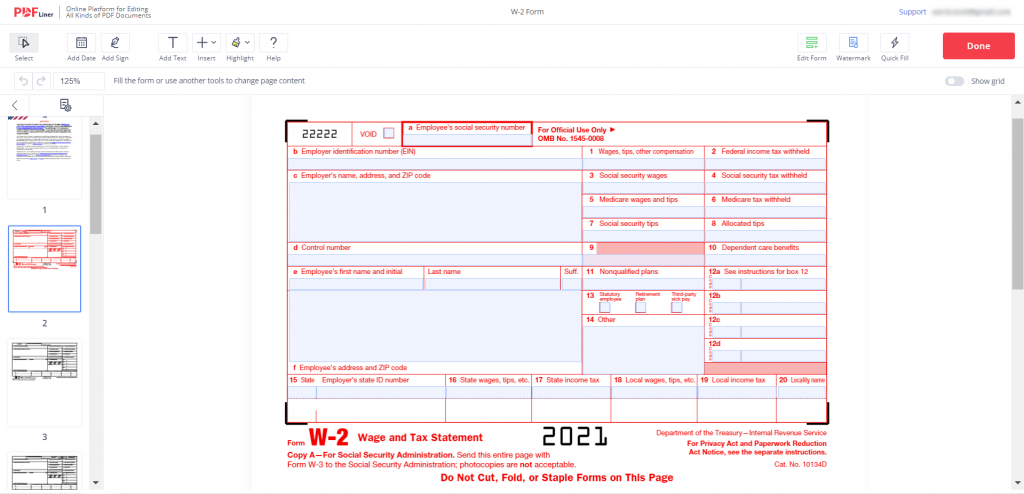

A W-2 form is a document given to employees at the end of the year. The W-2 form has information about the employee's income, tax withholdings, and benefits. The employee should always request their W-2 form from their employer for their records. It is important to keep a copy of the W-2 form in a safe place, in case it is needed for taxes in the future. If you forgot to request W-2 from previous employer this article is for you.

What Is a W-2 Form?

Form W-2 is a tax form issued by an employer to an employee, usually at the end of the year, that reports how much the employee was taxed and what the employer paid for the employee.

The W-2 also reports how much the employee was paid and how much was withheld for taxes. Workers should file a W-2 with the IRS to report their income and how much they paid in taxes. The deadline for this form to be filed is usually January 31st of the following year. Every employer is required by law to provide a W-2 form to employees. The form is used to determine how much tax has been withheld from your paychecks.

How to Get W-2 From a Previous Employer?

To get a W-2 from an old employer, an employee needs to request a copy of their W-2 in writing. The employee should mail the request to the address that is on the company's website or in the company's handbook. Employees should be able to get a copy of their W-2 from their previous employer. The employee should mail the request to the address that is on the company's website or in the company's handbook. If the previous employer refuses to provide a copy of W-2, the employee should contact the U.S. Department of Labor or IRS directly.

You should send IRS a letter and explain that they will be filing their taxes and need a copy of their W-2, but your previous employer refuses to provide it. The letter should contain the following information: Name, Address, Social Security Number, Date of Birth, and the Estimated Earnings for the previous year.

What if My W-2 Won't Arrive On Time?

The deadline for filing taxes is April 15th. You are worrying that you won't have the W-2 from your old job and it will arrive late, but you have some options. Your employer can't send it to you by mail on time, or you can request it, you can ask them to provide a photocopy of the front and back of the W-2. If your former employer does not have a record of your wages, you can provide a copy of your last pay stub and a letter from your employer explaining this. If you have not received your W-2 by April 15th, you can file your taxes on time by using your last pay stub as a substitute for the W-2.

If you are an independent contractor you can fill out your W-2 by yourself. In order to do this correct check out this step-by-step guide on how to fill out Form W-2.

Conclusion

Form W-2 is an important form that is used to report an employee's wage and income. This form is used by employers for tax purposes. So each year, the employee will receive a W-2 form from their employer. If the employee changes jobs, then they need to get a W-2 from their previous employer. Getting W-2 from an old employer is not always an easy process, so hopefully, this article helped you a little. By the way check out this amazing service – PDFLiner, with this service you can fill out and sign all your tax forms electronically.

How To Get W2 Form From Previous Employer

Source: https://pdf-to-dxf.com/blog/how-to-a-get-w-2-from-a-previous-employer/

Posted by: osbornedrel1998.blogspot.com

0 Response to "How To Get W2 Form From Previous Employer"

Post a Comment