Can You Deposit Money In Us From Offshore Gambling Accounts

At that place's a perception about offshore accounts that many people view them as only for savvy—and perchance shady—businesspeople and accountants.

But the truth is that anyone can legally open an offshore business relationship in a affair of hours with a lilliputian research and determination.

This article dispels some myths about offshore accounts by telling you what they really are and how you can open ane, if you'd like to.

Withal, if y'all're already living and/or working abroad or planning to move abroad, why not use the world'due south most international business relationship?

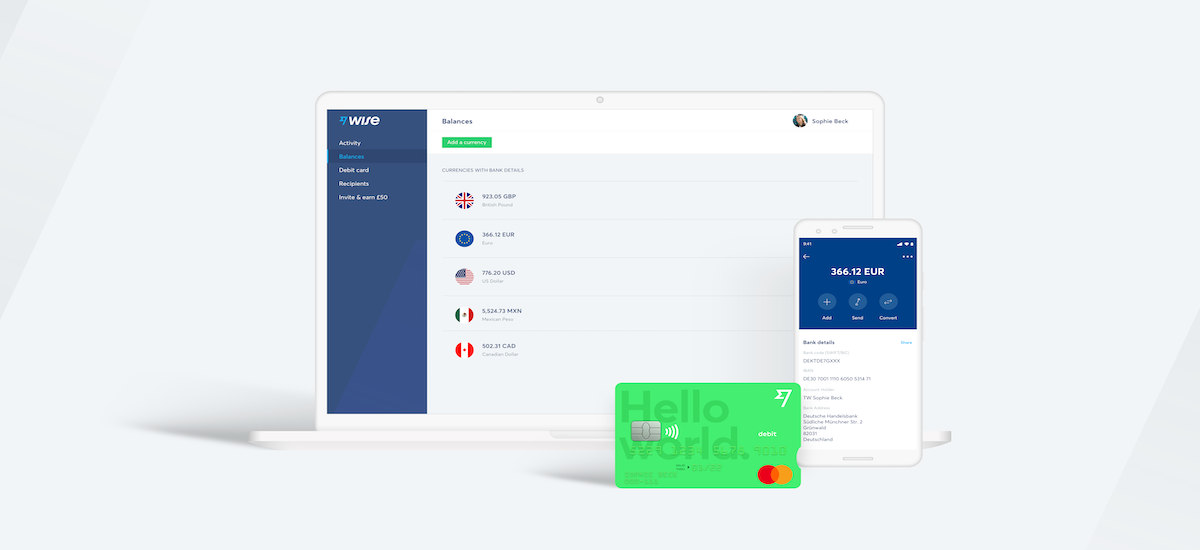

A Wise account is perfect for people who movement between countries for piece of work or make regular trips abroad can hold multi-currency balances, make direct debits, have access to several bank details, and apply an international debit card—merely more on this afterwards.

Open a complimentary Wise account today

| 📝 Table of contents |

|---|

|

What is offshore banking?

The simple definition of offshore banking is that it is banking done outside your dwelling house state. The term encompasses companies and individuals who invest and do business with international banks.

Over the past 50 years, Switzerland and the British territories of Bermuda and the Cayman Islands became renowned hubs for offshore cyberbanking. Just in recent years, Ireland, Belize, and the African nation Mauritius have also come into the spotlight.

Equally stated, many people take a perception that offshore banking is only for the rich, accountants, or wealthy criminals. Simply while those groups may utilise them, offshore banking itself is not an illegal action if you lot don't use i equally such—like for taxation evasion or money laundering.

For example, it's legal to put your money in countries that have unlike banking systems—if you follow the rules and regulations of the foreign and U.s.a. governments.

Why accept an offshore bank account?

People apply offshore banks for a variety of legitimate reasons like doing business or having investments outside of their dwelling house country or simply having an account somewhere they spend a lot of time.

Offshore accounts make things easier for you lot to honor financial obligations in a foreign country—sometimes multiple. They're a useful asset for people who take and make international payments regularly and for those who make a lot of international transfers.

Most expats living abroad utilize bank accounts in both their habitation state and in the country where they live. Yous could consider opening an business relationship in another country if you desire an efficient way to manage money away and possibly save and invest equally well.

Here's a rundown of some common reasons you lot would accept an offshore account:

- Y'all alive and/or work abroad already

- You lot have plans to piece of work or retire abroad

- You do business concern or your company regularly assigns you to work in multiple countries

- You regularly travel between countries for work, vacation, or to visit family

- You're a freelancer or businessperson who is paid in a foreign currency

| If any of those reasons use to you, Wise could be a great asset for your finances. With a free Wise account, y'all can get bank details in 10 currencies, which volition let you lot to pay and get paid just like a local. Plus, you can convert and hold balances in over 50 currencies. |

|---|

Go a costless Wise account with banking company details

Can a U.Southward. Citizen open an offshore banking company account?

Aye. At that place's no police force that prevents The states citizens from opening an offshore bank business relationship.

However, if yous intend to open an offshore business relationship, it's important to be aware of the revenue enhancement implications associated with the account—both reporting and possible payments.

The U.s. government passed the Foreign Account Tax Compliance Act—FATCA—in 2010 every bit a response to the 2008 financial crisis.

And while the law was created as a means for more transparency with global businesses, it also requires that US citizens—whether y'all're at home or abroad—report foreign holdings on their annual tax returns if they come across certain requirements.

Also, if you have more $ten,000 in offshore accounts, you must submit a Financial Crimes Enforcement Network—FinCEN—form 114, Report of Foreign Bank and Financial Accounts—FBAR—with your tax returns.¹

Notation that this is a combined total on all offshore accounts.

If yous're thinking most opening an offshore bank business relationship, be aware of the IRS rules and regulations. You may need to file both the FinCEN grade 114, FBAR and the FATCA form if you qualify.

Fortunately, the IRS offers a comprehensive comparison table of the FATCA and FinCEN rules, so you lot tin determine if and what you demand to written report.

How to open an offshore bank account?

Opening an offshore bank account isn't a complicated process. In fact, it's a lot similar opening an business relationship at a local banking concern in the US in that the financial establishment will require a lot of the same information, similar:

- Your name

- Proof of address

- Date of nascence

- Citizenship

- Occupation

And like your local bank, they'll require you to prove this information using a government issued ID—passport or commuter's license—and something like a utility bill or something similar.

Yous also may need to prove your income and investments with additional financial statements dating dorsum anywhere from six to 12 months.

In the statements, they'll review your transactions and wait to see that you have a practiced record with your bank. The bank may also inquire as to what you intend to use the business relationship for. This may seem invasive, but there has been increased international pressure to prevent illegal activity.

If you tin can provide all of that information, you should have no problem opening an offshore account.

How much does information technology cost to open an offshore bank business relationship?

Generally, virtually banks require a couple hundred US dollars and the documentation listed in the previous section. If you can come across those requirements, then you should be able to open an account in a matter of days.

But at only around $200 to $300, you may be thinking, "How practice offshore banks make money and then?" It's a valid question.

Most offshore banks make money from foreign transaction fees when yous transfer larger amounts of money into the bank.

As well, these financial institutions typically provide other fiscal services like in-house investments, brokerage accounts, and wealth management services that net bigger profits than their banking services.

Fortunately, it's now easier than ever to inquiry, investigate and transfer funds to any offshore bank you may consider a practiced fit for your needs.

Currencies

When yous open an offshore depository financial institution account, many times you lot have the selection of choosing which currency in which you want to hold funds. However, holding funds in different currencies tin come with consequences.

For example, if you earn interest on deposits in a strange currency, you lot could create foreign tax liabilities. Also, if y'all're constantly depositing and withdrawing in different currencies, you could exist striking with exchange rate upcharges.

Remember, this is how offshore banks ofttimes make their money, then be certain to research the fee structure and upcharges of any potential offshore bank.

| If you don't like the rates offered by banks, look into a Wise multi-currency account. Wise allows you to motility coin between countries and substitution currencies at the mid-market rate. Plus, you lot can always pay in the local currency when you're abroad. |

|---|

Making deposits

People don't often fly downward to the Caribbean with thousands of dollars in their pocket, so most offshore banking company accounts are virtually exclusively funded via international wire transfer.

However, the ACH or domestic wire transfer system that allows you to transfer coin for free in the US typically isn't bachelor when transferring money into an offshore business relationship.

While information technology's simple to brand the transfer—usually just a point and click on your computer—business relationship holders are often subject to international wire transfer fees when sending and receiving funds.

Withdrawing money

While depositing coin may have few avenues, withdrawing your money is another story. Offshore banks provide a plethora of ways to withdraw your funds as a ways of creating convenience for customers.

Most offshore banks provide international debit cards that allow you to admission funds anywhere yous get. This is another element you'll need to research, as fees tied to using the card can add upward quickly. If you lot're going to use an ATM, information technology's all-time to withdraw large sums of coin at once to minimize the fees.

Y'all may exist able to get checks from the offshore bank, just information technology's typically not preferred every bit the checks may not be accepted locally.

Near individuals with an offshore account use both a domestic and an offshore account in order to transfer funds locally for easy access. Doing things this way enables you to have more security and convenience with admission to your local bank.

| If you're looking for a debit card where you lot can spend money with no strange transaction fees, a Wise debit card is a solid option. With your Wise card, y'all can concord over fifty currencies for free and transport money right from your balances. Information technology's designed for people who live, work, travel, or back up family unit effectually the world—go a card today. |

|---|

Become a Wise debit card

Wise - The world'due south most international account

There are a lot of viable reasons for you lot to want a banking company business relationship abroad.

Y'all possibly live or work abroad or are planning to retire abroad. Peradventure you travel regularly to other countries considering of work or just holiday a lot. Maybe y'all're a freelancer dealing in strange currencies.

Whatever the reason, accept reward of the earth's almost international account.

A Wise account gives yous access to account details in ten currencies, and so you tin can pay in the local currency and get paid merely like a local. Use your banking company details to receive money from 30 countries—for costless—concur balances and convert funds in over fifty currencies, all with no local details required.

Plus, you lot tin convert those currencies at ridiculously low fees that are on boilerplate 7x cheaper than banks and other providers. Start receiving money from all over the earth for free and convert to the currency y'all need with Wise.

Learn more about Wise

Often asked questions

Is it legal to have an offshore banking concern account?

Yeah. Information technology is legal to have an offshore banking company account so long as you bide by the laws, rules, and regulations of both the The states authorities and offshore jurisdictions of the account.

Offshore banking is simply a blanket term for having a banking concern account outside of your habitation country. The aforementioned applies to an offshore company, it'southward a company operating outside the jurisdiction of its headquarters. Neither of these practices are illegal for Usa citizens.

Are offshore banking company accounts safety?

There is no piece of cake reply whether offshore banking concern accounts are safe or non.

What nosotros tin can suggest is that you lot use resource available to do your due diligence before putting money into any foreign bank account or investment. Some offshore banks may not offering the same nugget protection as the US cyberbanking organization.

The FDIC uses the CAMELS system to rate banks in the United states and abroad, and while their rankings are confidential, the organisation they utilize is a good template for researching whatsoever bank.

CAMELS stands for:

- Capital adequacy

- Nugget quality

- Management

- Earnings

- Liquidity

- Sensitivity

If you employ your resources to enquiry this information on any potential offshore banking company, y'all should be able to make an informed conclusion.

Sources:

- FinCEN - Report Foreign Banking company and Financial Accounts

All sources checked on 24 September 2021

This publication is provided for full general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is non intended to corporeality to advice on which you lot should rely. You must obtain professional or specialist advice before taking, or refraining from, any activity on the ground of the content in this publication. The information in this publication does not constitute legal, tax or other professional advice from TransferWise Express or its affiliates. Prior results exercise non guarantee a similar result. We make no representations, warranties or guarantees, whether express or implied, that the content in the publication is accurate, complete or up to date.

Source: https://wise.com/us/blog/offshore-bank-account

Posted by: osbornedrel1998.blogspot.com

0 Response to "Can You Deposit Money In Us From Offshore Gambling Accounts"

Post a Comment